On the First 5000. Increase in Deduction for SpousePayment of Alimony to former Wife.

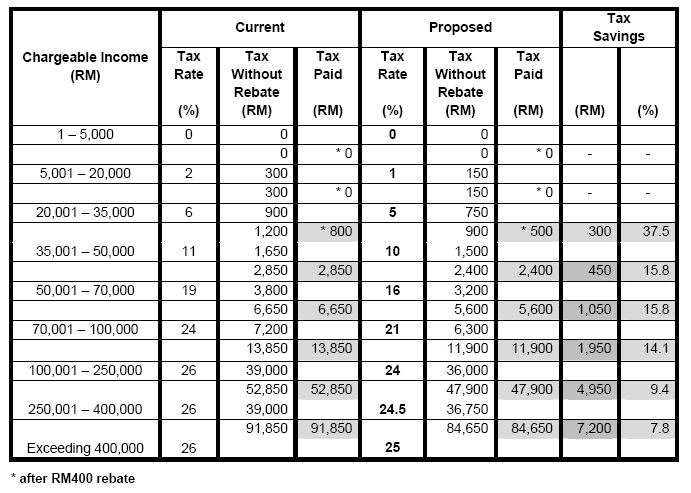

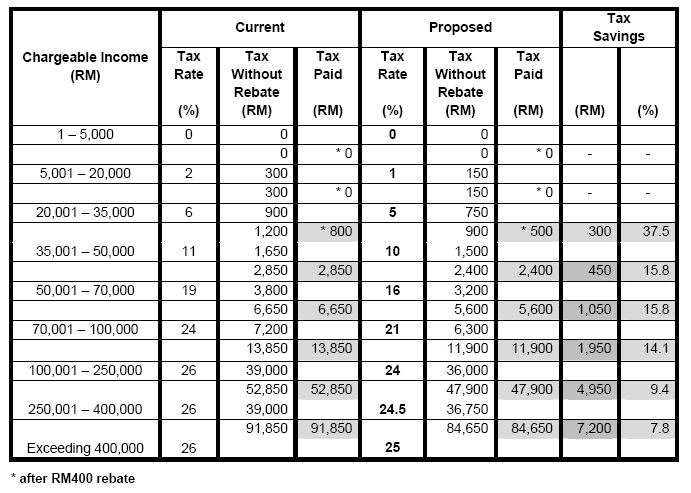

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

52 The income of a seafarer from employment exercised on board a ship operated by a person who is not resident.

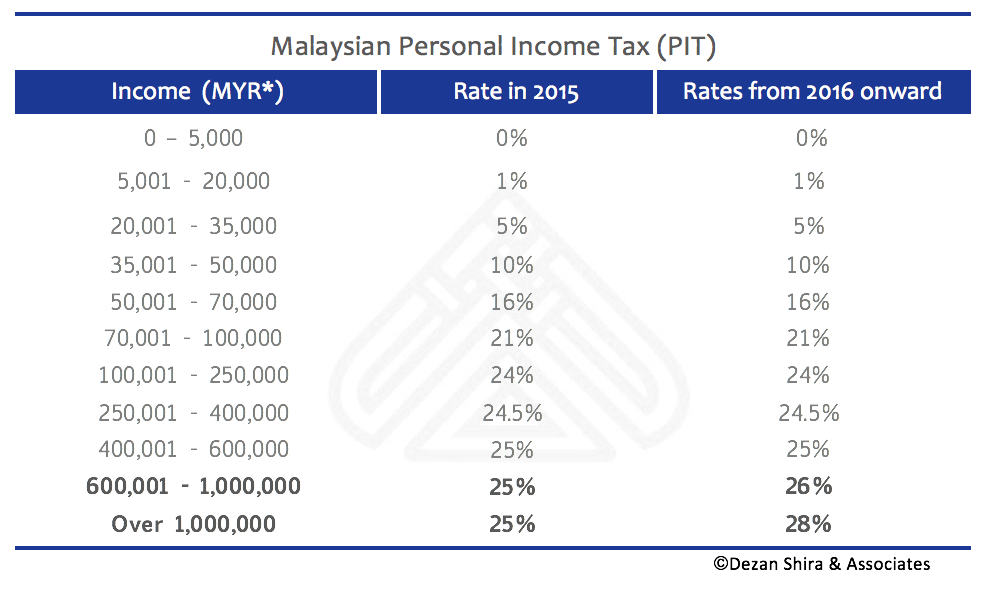

. Personal income tax rates. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Malaysia Taxation and Investment 2016 Updated November 2016.

Income Tax Rates and Thresholds Annual Tax Rate. Calculations RM Rate TaxRM A. 13 rows An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia.

From 25 to 28. Malaysia personal income tax rate 2016 Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News Pin On Datesheets. 33 Taxable income and rates 34 Capital gains taxation 35.

While the 28 tax rate for non-residents is a 3 increase from the previous. In Malaysia 2016 Reach relevance and reliability. Tax Rates - 2016.

Malaysia personal income tax rate 2016. Tax Rates for Basis Year 2016. 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the.

Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia. Technical or management service fees are only liable to tax if the services are rendered in Malaysia. Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased.

Malaysia Non-Residents Income Tax Tables in 2019. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

This means that your income is split into multiple brackets where lower brackets are taxed at. Non-resident individuals income tax rate increased by 3. On the First 5000 Next 15000.

Vc_row full_widthstretch_row_content typefull_page_width_inner_container padding_top padding_bottom. Assessment Year 2016 2017 Chargeable. Hence the income is subject to tax in Malaysia.

Malaysia Payroll And Tax Activpayroll

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

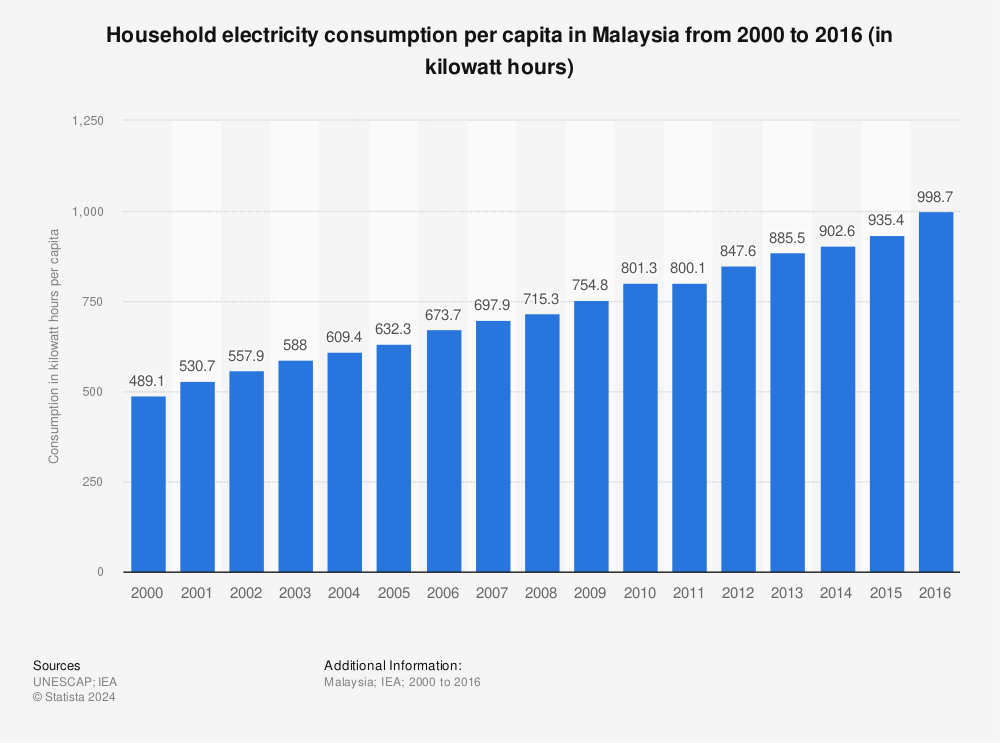

Malaysia Household Electricity Consumption Per Capita 2016 Statista

Malaysia Number Of Households Statista

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Income Tax Formula Excel University

The Malaysia Budget 2015 Will Be Announced By Datuk Seri Najib Razak On October 10 2014 At The Parliament This Infographics Sho Budgeting Infographic Malaysia

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

An Employee Weighs An Ingot Of 99 99 Percent Pure Gold Today Gold Price Gold Trader Today Gold Rate

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Malaysia Household Electricity Consumption Per Capita 2016 Statista

Genting Highlands Malaysia The Best Place For Property Investment In Malaysia For 2018 Investment Property Investing Property

Rising Tiger Philippines Posts Some Of The World S Fastest Growth Philippines New Growth World

Screen Shot 2016 02 14 At 2 35 35 Pm Asean Business News

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News